Mortgage Planning Tips for First-Time Home Buyers in Canada

Are you looking to buy your first home in Canada? If so, you’ll need to start planning your mortgage early. Here are some tips to help you get started.

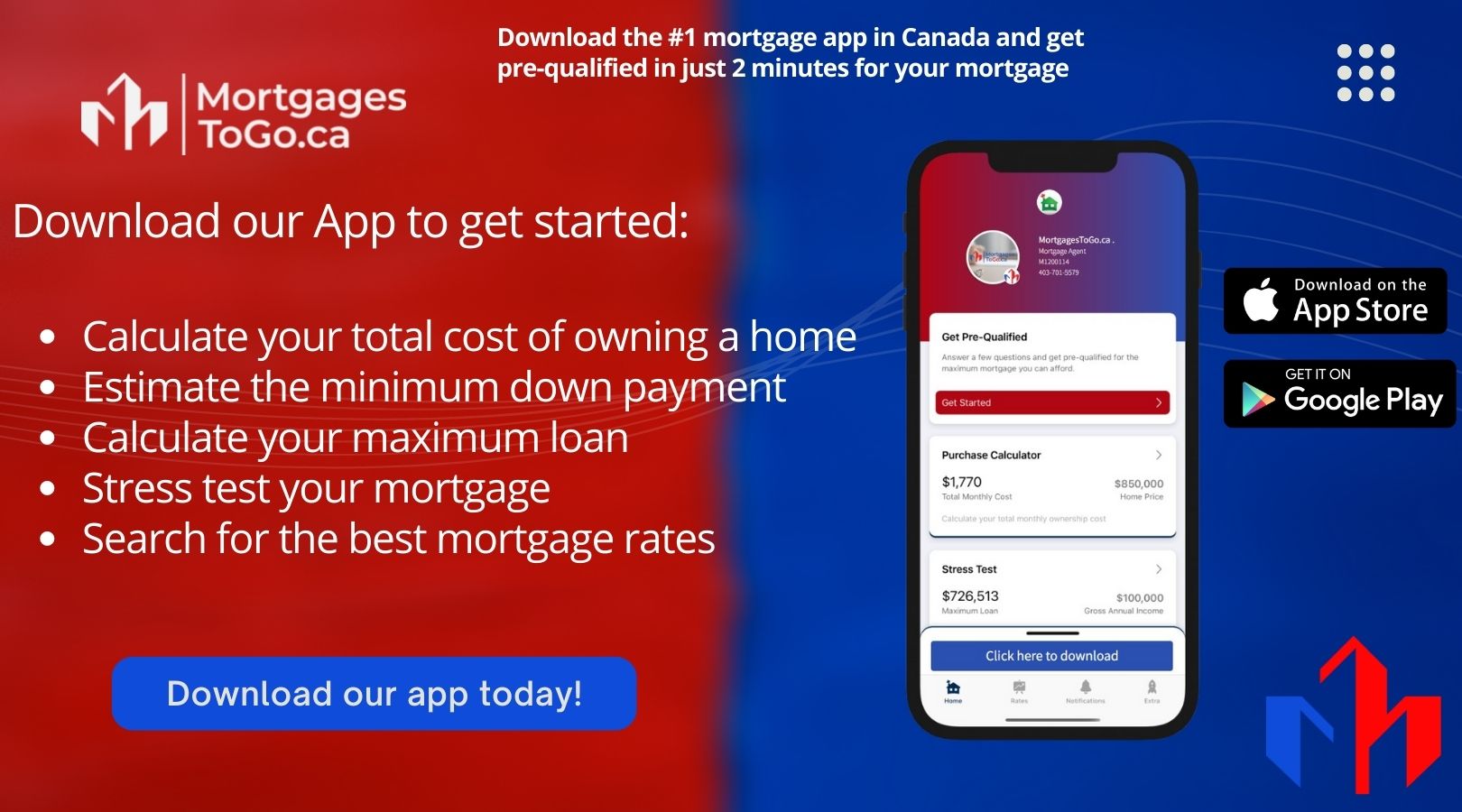

1. Shop around for the best mortgage rates. Don’t just go with the first lender you talk to. Compare rates from a few different sources before making a decision. In the end, you will learn that Mortgagestogo.ca can save you thousands of dollars with the Best Mortgage Rates in Canada – also ask us where the prime rate is headed, as we will advise what type of mortgage is best for you in this market.

2. Consider all the costs involved in buying a home, not just the monthly mortgage payments of principal and interest.

3. Get pre-approved for a mortgage before you start shopping for homes. This will give you an idea of how much you can afford to spend, and it will also make the home-buying process a lot easier. You can get pre-qualified with our mortgage calculator in minutes with mortgagestogo.ca

4. Make sure you have a good down payment saved up before you start looking at homes. The more money you can put down, the lower your monthly payments will be.

Introduction

Purchasing a home is likely the biggest purchase you will ever make, so it’s important to be well-prepared before taking the plunge. Here are a few things to consider before you start shopping for your first home in Canada.

The first step is to figure out how much you can afford to spend on a home. The best way to do this is by getting pre-approved for a mortgage from a lender. This will give you an idea of the interest rate you can expect to pay and how much house you can afford.

Once you have saved up enough for a down payment and closing costs, it’s time to start shopping for your dream home! When comparing properties, be sure to look at the total cost of ownership, including property taxes, maintenance fees, and utilities. And don’t forget to factor in your daily commute when choosing a neighbourhood – after all, you want to be happy with where you live, not just your house!

The Mortgage Process

The mortgage process begins with pre-approval. This is when your lender gives you a letter stating how much they’re willing to lend you, based on your income and credit score. Once you have pre-approval, you can start shopping for a home within your price range.

When you find a home you want to buy, your real estate agent will help you put together an offer. If the seller accepts your offer, the next step is to get a mortgage commitment. This is a letter from your lender saying they’re willing to give you a mortgage for a specific amount, at a specific interest rate, with specific terms and conditions.

Once your mortgage is approved and all the paperwork is in order, it’s time to close the deal and sign the mortgage documents. After that, the house is yours!

Mortgage Types

There are many different types of mortgages available to first-time home buyers in Canada. It can be confusing to try to figure out which one is right for you, but it’s important to do your research and understand the different options before you make a decision.

The two most common types of mortgages for first-time home buyers in Canada are fixed-rate, variable-rate, and balloon mortgages. With fixed and variable being more popular.

A fixed-rate mortgage is exactly what it sounds like – your interest rate will be “fixed” for the duration of your mortgage term, meaning that your monthly payments will stay the same even if interest rates go up or down. This predictability can make it easier to budget for your monthly expenses.

A variable-rate mortgage (VRM) has an interest rate that changes over time. The initial interest rate is usually lower than a fixed-rate mortgage, but after a certain period of time (usually five years), it will adjust based on market conditions. This means that your monthly payments could go up or down, making it harder to predict your monthly expenses.

Mortgage Terms

The term of your mortgage is the length of time you have to pay back your lender. In Canada, mortgage terms are typically for 5 years, but you can extend or renew your term if you need to.

The interest rate on your mortgage is important, but it’s not the only factor that will affect how much your monthly payments are. The term of your mortgage will also affect how much you pay each month.

A shorter term usually means higher monthly payments, but it also means that you’ll pay less interest over the life of your mortgage. A longer amortization period usually means lower monthly payments, but it also means that you’ll pay more interest over the life of your mortgage.

You can use our Mortgage calculator to see how different mortgage terms would affect your monthly payments.

Mortgage Insurance

Mortgage insurance is an insurance policy that protects the lender in the event that you default on your loan. If you do not have mortgage insurance and you default on your loan, the lender can foreclose on your home and sell it to recoup their losses.

The Down Payment

One of the biggest financial hurdles of buying a home for the first time is saving for a down payment. In Canada, the minimum down payment is 5% of the purchase price of the home. Pools of money have been set up by the government to help with financing, but they come with income restrictions. The minimum down payment cannot be made with a credit card or personal loan—it must come from your own savings, a gift, or a government program.

Closing Costs

In addition to your down payment, you’ll also need to budget for closing costs. These are the fees associated with getting your mortgage and include items like the home appraisal, property taxes, and your credit check.

Closing costs can vary depending on your lender, the price of your home, and where you’re buying, but they typically range from 1-5% of the purchase price.

The First-Time Home Buyer’s Checklist

The First-Time Home Buyer’s Checklist

Purchasing your first home is an exciting milestone, but it can also be a daunting task. To help make the process a little easier, we’ve put together a first-time home buyer’s checklist that covers everything from budgeting to finding the right property.

1. Determine your budgets. This includes not just your mortgage payments, but also things like utilities, insurance, and repairs.

2. Get pre-approved for a mortgage. This will give you an idea of how much you can borrow and whether you qualify for any special programs like low-down payment options.

3. Start saving for a down payment and closing costs. You’ll need at least 5% of the purchase price for a down payment, and another 1-5% for closing costs such as lawyer’s fees and land transfer tax.

4. Find a real estate agent you trust. This person will be your guide through the entire home-buying process, so it’s important to find someone you’re comfortable with and who has your best interests at heart.

5. Attend open houses and viewings to get an idea of what kind of property you’re looking for and what’s available in your price range.

6. Make an offer on a property you love! Once your offer is accepted, it’s time to start planning for your big move!